A Reserve Study is only an effective budget and planning tool if the board members and property manager are able to fully understand the information provided in it. Many people quickly look at the charts of numbers and ask, “We have to set aside how much?”...without really understanding what’s behind it. If you’re a board member, this brief article will help you better understand your associations’ reserve study. If you’re a manager, it will help you to better explain the study to your association. In this article, we’ll briefly look at the two most commonly misunderstood financial aspects of the study; the components annual accrual, and the fully funded balance.

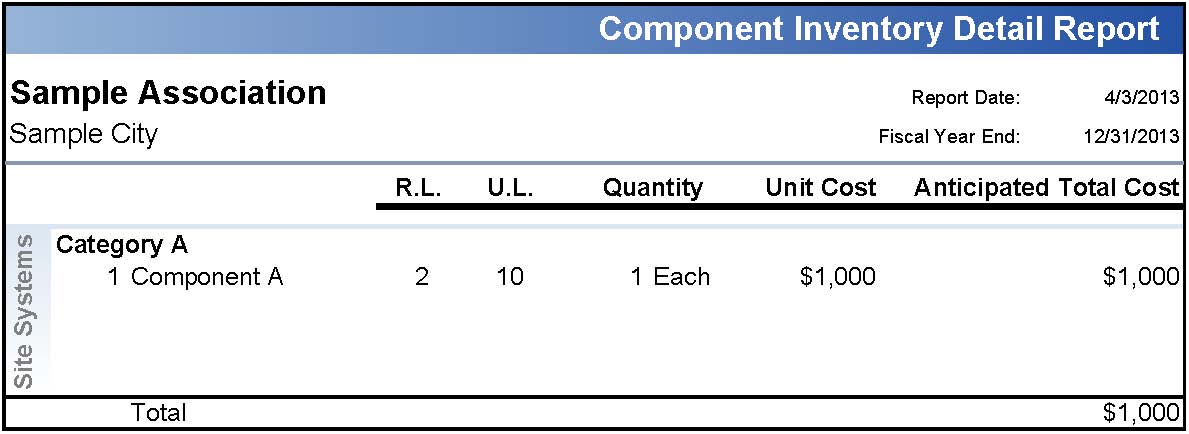

The best way to illustrate these two terms is to provide an example in which we strip everything down to the basics. To start with, we’ll take away inflation, interest, natural disasters, costs overages, etc., and focus on the basic component which we’ll call Component A. Let’s say our component costs $1000 to replace and will last for 10 years. If you were looking at our report, the component line would look something like this:

What this table is saying is that we expect the item to last for 10 years (Useful life: UL) and that it has 2 years remaining before it will have to be replaced (Remaining Life: RL) for a cost of $1,000 (Unit Cost). Since there is only one unit, the total cost is the same as the unit cost.

Now in order to be able to replace Component A in 10 years, you would have to put aside $100 every year. The $100 is called the Annual Accrual and it is calculated using the following formula:

Component’s Annual Accrual = Total Cost/Useful Life

Since Component A has 2 years of Remaining Life, which means that $800 should have already been put away for its replacement, $800 is the Fully Funded Balance. If the association only had $400 in their reserves for this component, we would say that the association is 50% funded. The fully funded balance can be calculated as follows:

Fully Funded Balance = (Unit cost/Useful Life) X (Useful Life – Remaining Life)

So from our example: ($1000/10) X (10-2) = $100 X 8 = $800

The final part related to this topic stems from the question, “Is my association adequately funded?” There is no exact or simple answer to this question, which is why you should consult with a professional Reserve Preparer. The answer to the question of how much needs to be set aside varies according to every association’s particular funding goals and plans. However, with proper understanding of the reserve study, you will be able to work together with your reserve preparer to help create a financial plan that will be a powerful and effective tool for you and your HOA.