NOTE: This article explains how to present the SMA Reserves’ Reserve Study Report to board members or owners. For a full sample of our Reserve Study Report please Click Here.

Reserve study reports can often be confusing for homeowners, boards, and even professional managers. Even the most easily read reports have unfamiliar terms and large charts of numbers that take a little bit of understanding to figure out. Mangers often ask us; “How do I present the Reserve Study to the board in a way that makes it easy for them to understand?” Don’t worry, we have the answer!

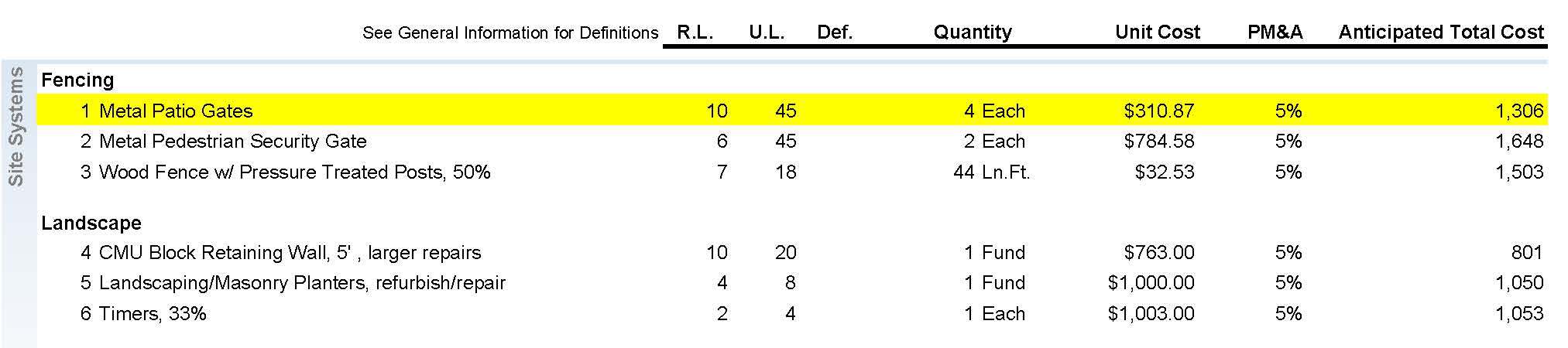

All reserve studies have two parts: 1) the component information gathered from the on-site inspection and 2) the financial analysis of that data. The first step should always be to flip through the report and quickly glance at each page so that you know where everything is. Next, turn to the page with the component list and go through it line by line. Look through the component names and make sure that everything makes sense to you. Sometimes, a component may have a name that is widely used in the construction industry but you may be unsure exactly what is being referred to. We’re here to help, so don’t hesitate to contact us for clarification.

The next step is to look at the R.L. (remaining life), U.L. (useful life), Unit Cost and Unit Count for each component. This is the most important part of the study because if these numbers are inaccurate, it affects everything in the study and limits the value of the report. It’s the reason an experienced site inspector is key to a good study. Take your time and go slowly through each component checking the costs and counts with the association’s historical data and previous reserve studies to ensure that everything is accurate. Once the board is satisfied with the accuracy of the component list, you can move on to the financial analysis.

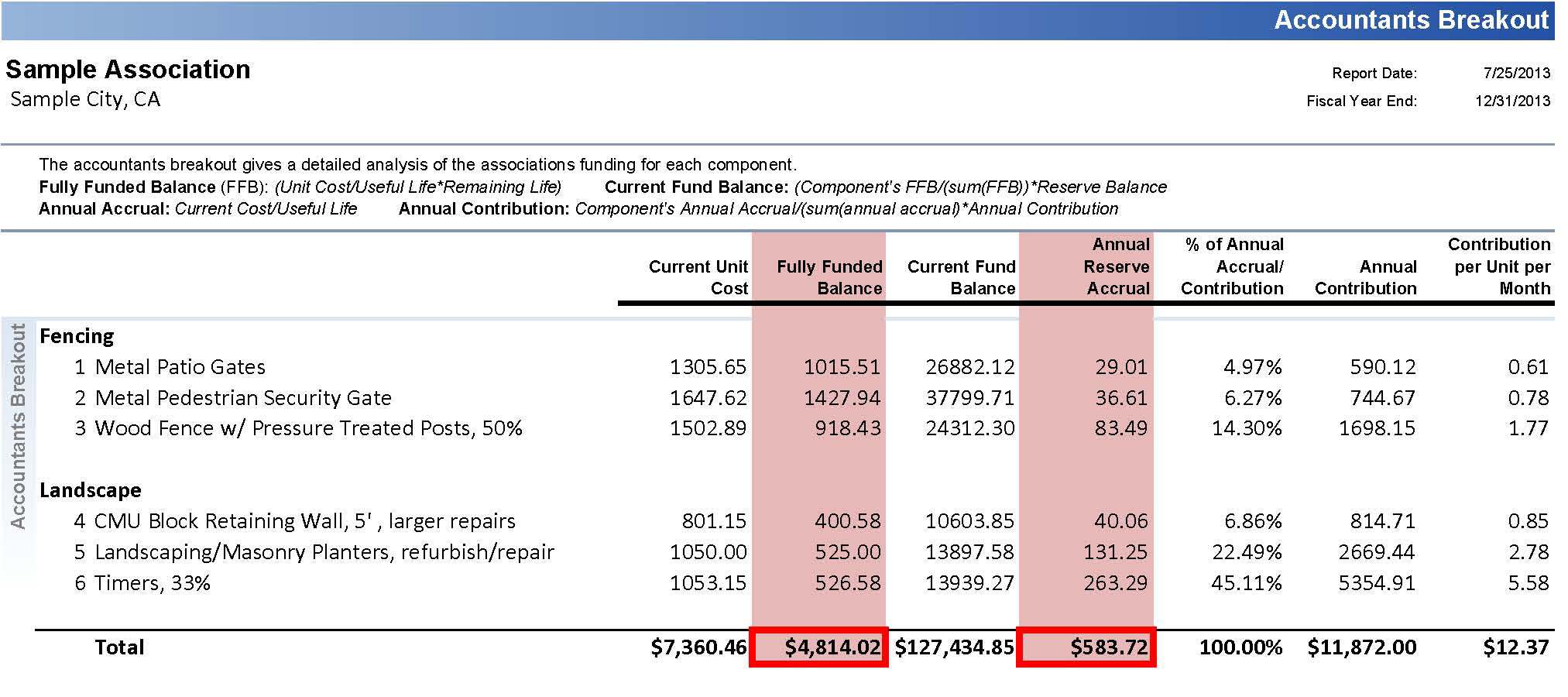

Prior to presenting the study, you should have a solid grasp on what the terms annual accrual and fully funded balance mean. I’ve written an article helping to explain both terms which you can find by Clicking Here. In an SMA report, the annual accrual and fully funded balance are at the end of the Accountants Breakout report and forms the basis for our financial recommendations. Once you know where you should be, you can take a better look at how to get there.

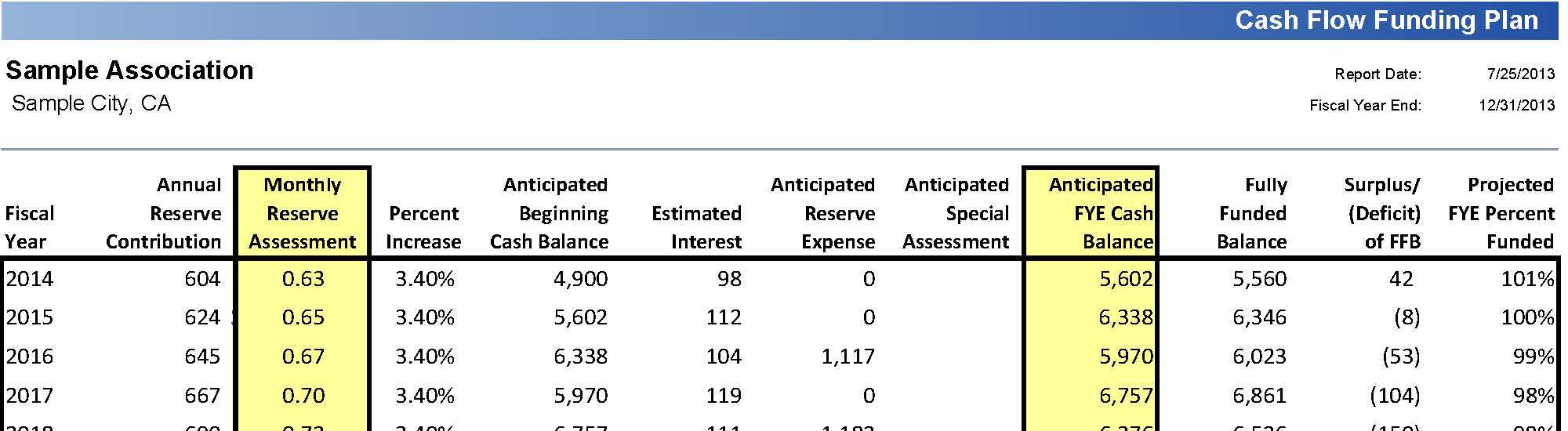

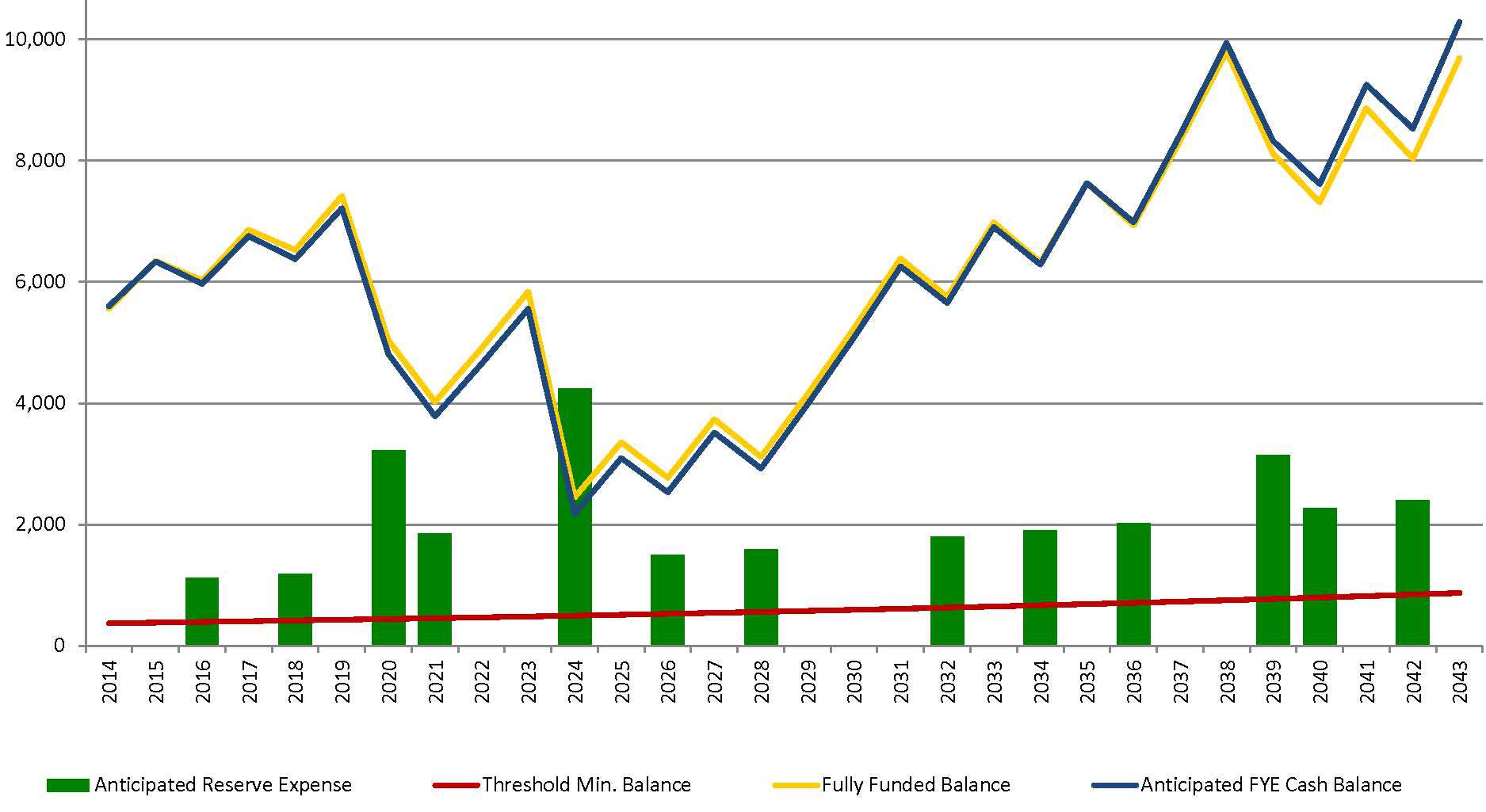

In our Reserve Study report, we gather all of the financial information into the report titled Cash Flow Funding Plan. It contains a large chart with numbers that essentially explain how much money the association will have each year. The following page contains a graph which visually explains all of this data. On the chart you’ll see two columns highlighted in yellow - the first is the monthly reserve assessment per unit and the second is the association’s anticipated fiscal year end cash balance. The per unit assessment is our recommendation in order to help the association stay healthy financially for the long term. Depending on how well funded the association may be this could either be higher or lower than the actual annual accrual of the components.

At this point the board will already have an understanding of where the costs are coming from and now it’s time to look at what they need to do moving forward. If the board strictly follow the repairs and reserve contributions laid out in the report, they should stay on or near the fiscal year end balances that we have anticipated. If the board is more comfortable with a higher percent funded then they can also increase the contributions and we can create a model for that. However if the owners are struggling to even pay the current HOA dues, we can work with them to create a financial plan that will work within their means and goals.